Cancel Medical Debt

A new study shows Americans have $140 billion in medical debt. Time to end it.

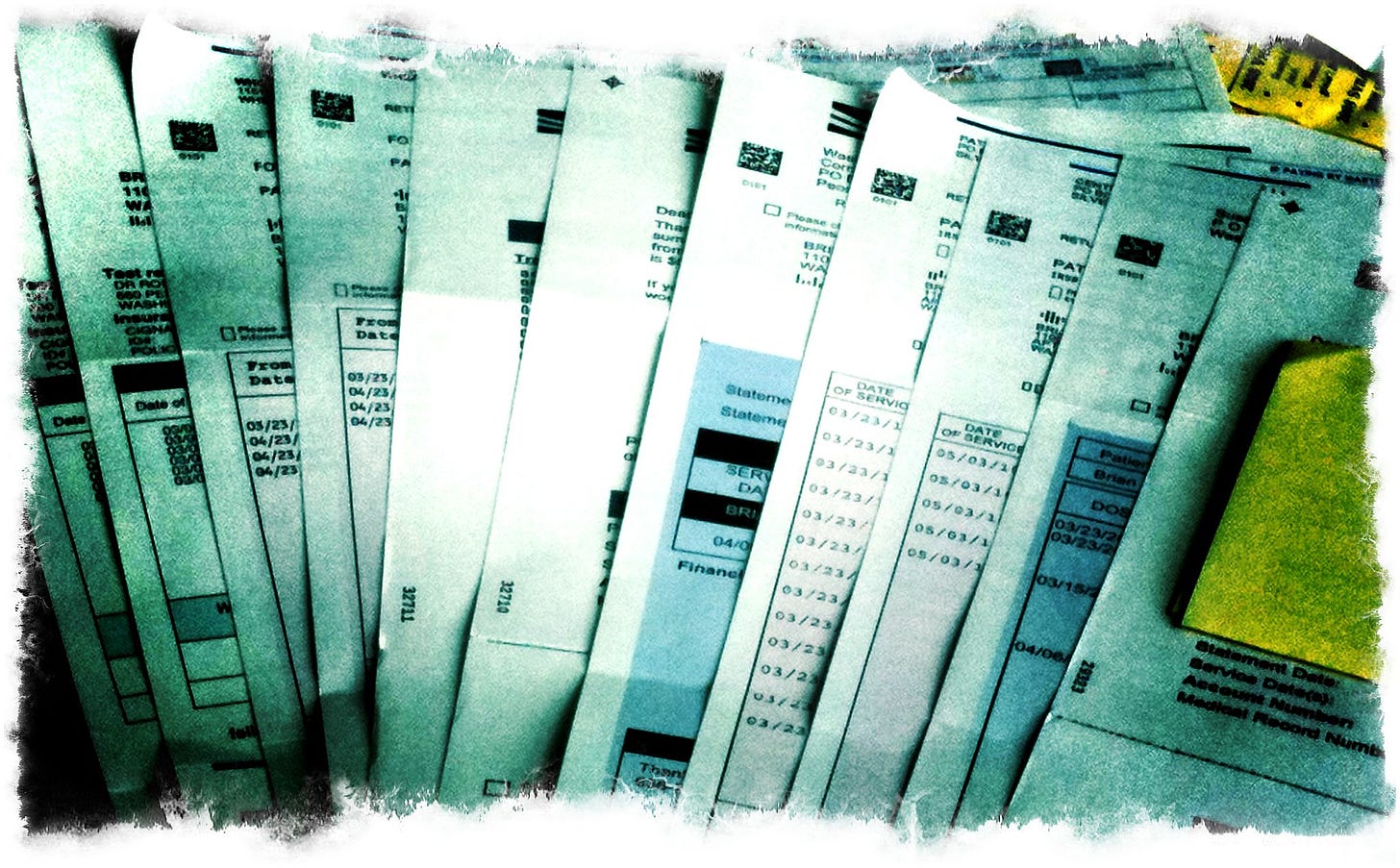

It's a crowded field, but there are few things unique to American life that are bleaker than the concept of medical debt. So it's a good thing, then, that it turns out there's much more of it than we previously knew.

Nearly one in five Americans, to the tune of $140 billion, had medical debt in collections between January 2009 and Ju…

Keep reading with a 7-day free trial

Subscribe to Discourse Blog to keep reading this post and get 7 days of free access to the full post archives.