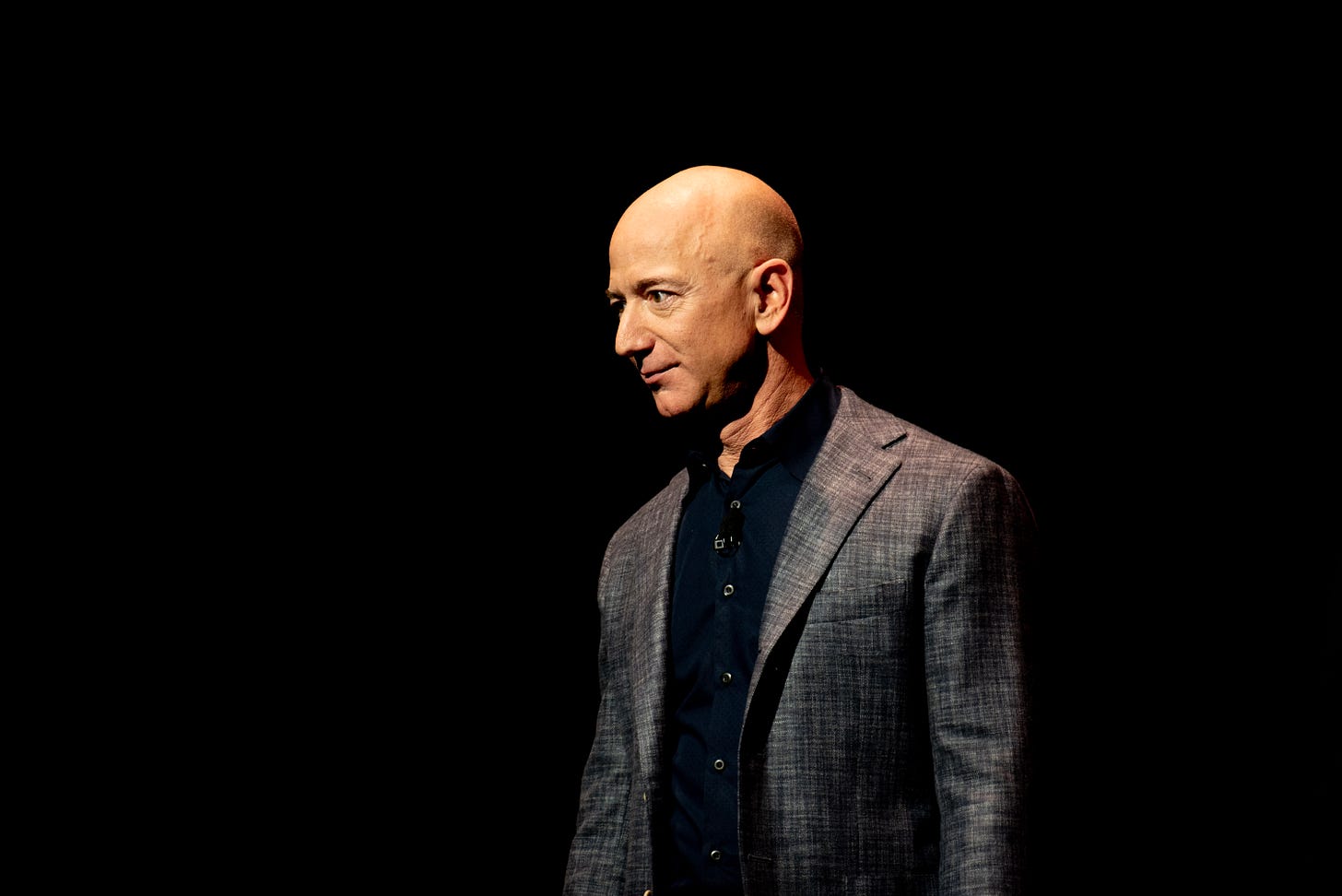

The Super-Rich Are Robbing Us Blind

A blockbuster report shows exactly how much the wealthiest men in the world are stealing from the rest of us.

We know, on an intrinsic level, that the very rich are stealing from the rest of us. That's capitalism baby, and so forth. But it is always worth knowing exactly how the rich are stealing from us, and that is why today's blockbuster report from ProPublica about the tax affairs of the wealthiest people in America is so valuable.

The i…

Keep reading with a 7-day free trial

Subscribe to Discourse Blog to keep reading this post and get 7 days of free access to the full post archives.