The COVID Housing Crisis Is Crushing the Service Industry

'There's such a lack of housing, any time I run an ad there's no response.'

This piece by Eoin Higgins was originally published on The Flashpoint, which, like Discourse Blog, is part of the Discontents media collective. Discontents now has a Discord server; get details here.

This week, get 20% off an annual subscription to The Flashpoint by clicking here.

by Eoin Higgins for The Flashpoint

The service industry is in a labor crunch—and housing costs are making things worse

In tourist towns like Ouray, Colorado, high prices for homes and apartments are making attracting and keeping staff hard, if not impossible.

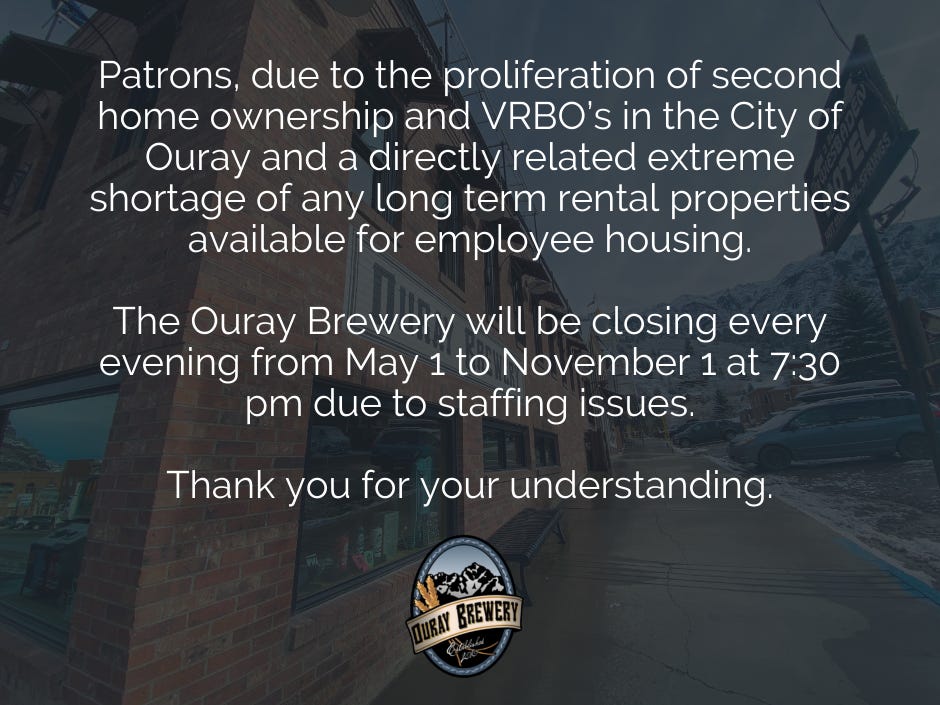

Local pub the Ouray Brewery called out the town's real estate market as the reason they were closing every night at 7:30pm in a Facebook post on June 5.

"We are closing earlier due to the proliferation of second home ownership and Vrbos in the City of Ouray and a directly related extreme shortage of any long-term rental properties available for employee housing," the brewery said.

Rising prices

"The combination of sale prices going through the roof, tenants being displaced, and the bulk of the homeowners being second homeowners—it's a huge problem," Erin Eddy, owner of the Ouray Brewery, told me.

With a local economy dependent primarily on tourism, Ouray relies on the service industry. The housing crisis, driven by second homeowners driving up prices and AirBnB competitor Vrbo, is imperiling that business, said Eddy.

As the Ouray County Plaindealer reported in September 2020:

According to data from the Colorado Association of Realtors, 70 single-family homes have sold in the county this year through August, up from 58 through last August. Fifteen were sold this July, compared to 11 last year, and August sales more than doubled, from 7 in 2019 to 18 this year. Median sales prices are also higher than last year, up to $572,500 for single family sales compared to $547,000 last August, and from $261,000 to $277,450 for townhouses and condos.. The year to date median sale prices have also increased, from $452,500 to $509,500 and from $270,000 to $295,000 for homes and condos, respectively.

The housing crisis is pouring fuel on that fire.

"There's no way to live up here"

Eddy's brewery offers front of the house workers between $10 and $14 an hour, he said, and the offers back of the house workers between $18 and $27 an hour. Other service professionals in different restaurants in the town that I spoke to, on background, confirmed that those salaries were in range for the area and that a lack of housing has helped force early closing times.

“If I offer someone a $50,000 or $60,000 a year job opportunity, that's not not enough money, even on a professional basis, to buy a $600,000 home and take care of your family,” Eddy told me.

Up the mountain and 35 to 40 minutes away from the nearest large town, Montrose, Ouray is a difficult place to reach.

That relative inaccessibility makes the remote little town a hard sell for anyone in Montrose to come to work in—especially when that means a long commute after a long night of work. But the town's housing prices have made living in Ouray impossible and have left workers and businesses both in the lurch.

"There's such a lack of housing, any time I run an ad there's no response," Eddy said. "It's because, I think, people are aware of the problem or they're aware that there's no way to live up here, or if they were to want to work for me, they would have to commute."

Perfect storm

The restaurant business is facing a nationwide labor shortage. As I reported last month, that's due in large part to the working conditions and pay and how the coronavirus pandemic made it impossible to ignore the reality of the industry.

“I think like with everything else in society, the pandemic kind of stripped away the illusion of fairness/equity in the industry, or that it operated differently than other industries,” Sarah, a restaurant professional who is leaving the industry, told me.

As Restaurant Business, an industry trade journal, reported, the labor market is tight because of higher job vacancies—up 68%—and a level of job seekers that's remained flat. And only about 4% of those not returning to the industry are doing so because of unemployment benefits, a frequent fallback villain for business owners.

A much larger group—38%—want to work but are unable to do so because of family obligations or scheduling that changed during the pandemic. And 16% want to work but are waiting for more people to get vaccinated.

Another 33% of respondents aren’t actively looking for work because they’re burned out from long-term unemployment. Also in the mix are the numbers of restaurant and hospitality workers who changed industries to find competitive work at a better wage.

Read more about the restaurant industry

Crisis

Ouray isn't the only place where rising home prices are pricing out the working class. In Jackson Hole, Wyoming—about 521 miles north of Ouray—the housing crunch is driving people out of the city even as the new residents demand more services.

The town's Joint Affordable Housing Department Director April Norton told local news outlet Buckrail that housing was a "crisis."

“The ratio of help wanted ads to available rentals is astounding,” Norton said.

As Bloomberg reported, the housing crunch is making money for homeowners—but leaving renters in the lurch nationwide.

On the outside looking in are renters like Carmer, 35, and his wife, Betsy Herrington, 38, a teacher. Their top priority is a nice backyard for their 3-year-old daughter, Chloe. But they keep getting outbid. According to Redfin Corp., the online brokerage they’re working with, 72 houses in metro Austin have sold for $300,000 or more above their asking price in 2021 alone. Herrington says Chloe is sick of the hunt. “She cannot handle going to another house. She says, ‘We’re not going to look at a house, Mommy?’ ”

People in the tourist-driven Berkshires region of Massachusetts are also reporting housing costs so high they're pricing people out of the area.

Sara Morandi, who lives in the area, told me that even though she and her husband are pre-approved for a mortgage, they're getting overbid on everything.

"We're pre-approved for a mortgage and people keep coming in with cash offers and don't even intend to live in the house,” she said. “You can't even use an FHA loan right now.”