We all have a story about taxes.

Maybe we were surprised by the IRS, or couldn’t pay what we owed, or got priced out of homes because we couldn’t afford the taxes.

We think about these stories when we’re checking our banking accounts or are filling out our contractor forms or get email reminders for tax season.

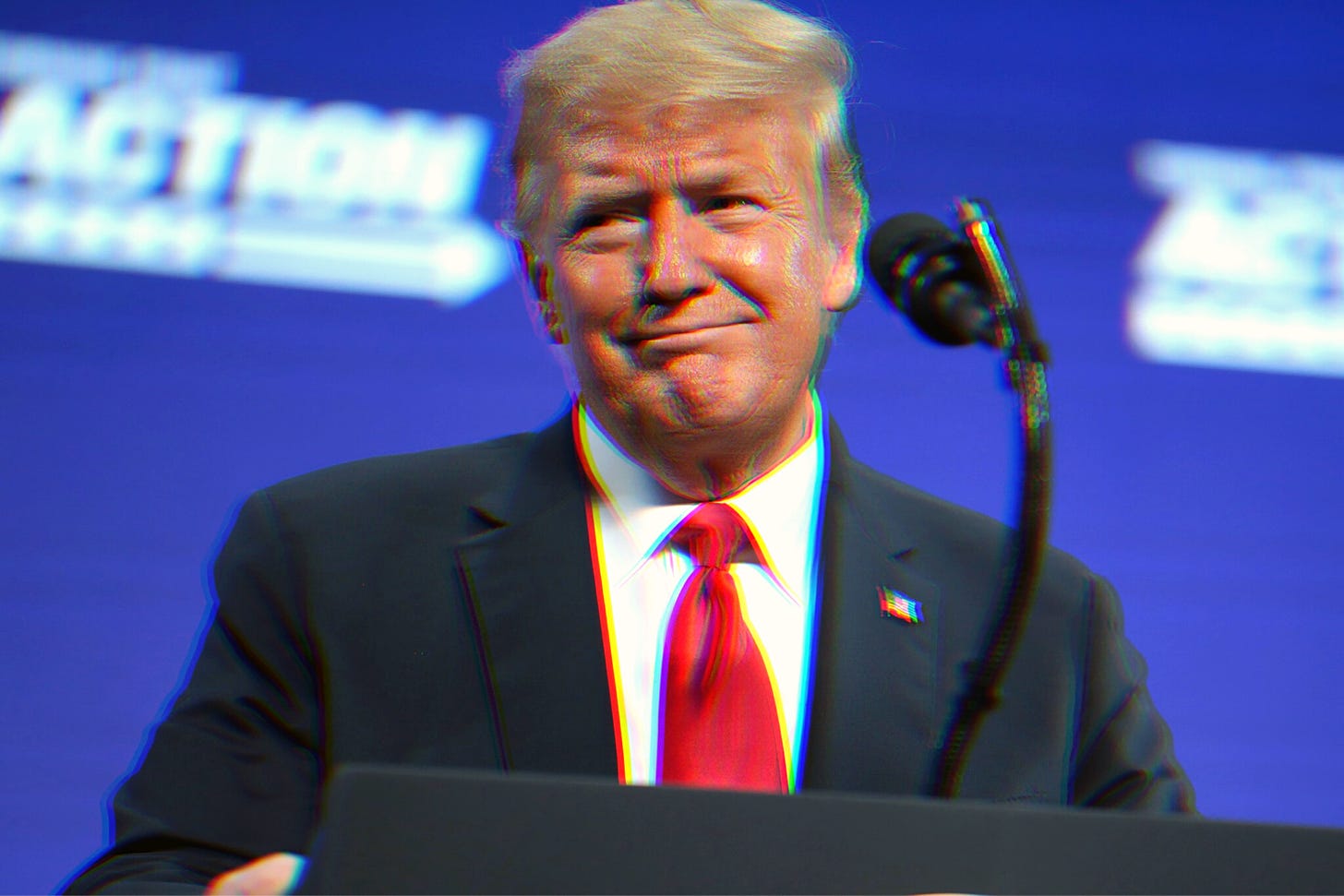

Regardless of the many necessary services that taxes pay for, these reminders loom and feel burdensome. And when we learn the extent to which someone such as Donald Trump took advantage of our fucked up tax codes, these reminders become all the more aggravating.

A few years ago, when I was about two years out of college, I got a notice from the IRS that I owed about $3,000. It was for a student loan that I had gotten “forgiven” through a Texas loans program; unbeknownst to me, it had become taxable income. My dad’s advice was to pay it off immediately — better to get the IRS off my back now, he said — so I borrowed $1,000 from my parents and took the rest out of my savings. I was moving out of my apartment at the time, and when it was over I had just enough to pay the movers and have a few hundred in my savings left over.

When I read the New York Times report on Trump’s taxes, I couldn’t stop thinking about my own experience. Even if this doesn’t change anything for anyone — if Trump voters don’t care that he’s an immense grifter — this still hurt for me. And so we want to hear about what this Times report brought up for you, because I know we’re not alone, and neither are you.

Email me at sam@discourseblog.com with your accounts of any notable experiences with the IRS, or taxes generally. We’ll put some of your responses together in a blog. Anonymity is totally cool—we’ll keep you safe and we won’t share any identifying details if you don’t want us to.

I hope that at the very least, your submission can be some means of catharsis, for you and the many other people who’ve surely found themselves in similar situations.

Photo of Donald Trump via gageskidmore/Flickr; Remix by Samantha Grasso

There was this time when my taxes paid for drone strikes on civilians, and I was all like, “That’s not what I voted for!” What the hell, man.

I've never had a big issue with the IRS or taxes.

After I moved to Seattle, Michigan sent me a letter saying I owed from my last year in state and I mailed a copy of my cleared check and that was that...I think, never heard any different.

I did have years where I couldn't afford to pay the full federal bill due and I paid the fees to pay in installments for a few years. There was also a year I transposed by numbers and paid short and they sent me a notice and I paid the balance. I don't think I had to pay a late fee but if I did it was so small that I can't remember it.

I find taxes to be easy but there is no reason we don't do what other countries do and just have Treasury send us a bill or a refund...they know what every w2 employee makes and pays.

I'm not sure if other countries have a 1099 equivalent so not sure how they work that.