If Trump's Taxes Make You Mad Let Me Introduce You to American Capitalism

Our tax system invites manipulation by anyone rich enough to do it.

A couple of years ago, I received a tax bill of over $7,000. At the time, I was freelancing and barely scraping together enough money to pay my bills. I was only able to pay about $1,000 of the bill immediately, so, every month for nearly two years, the IRS has taken $120 out of my bank account.

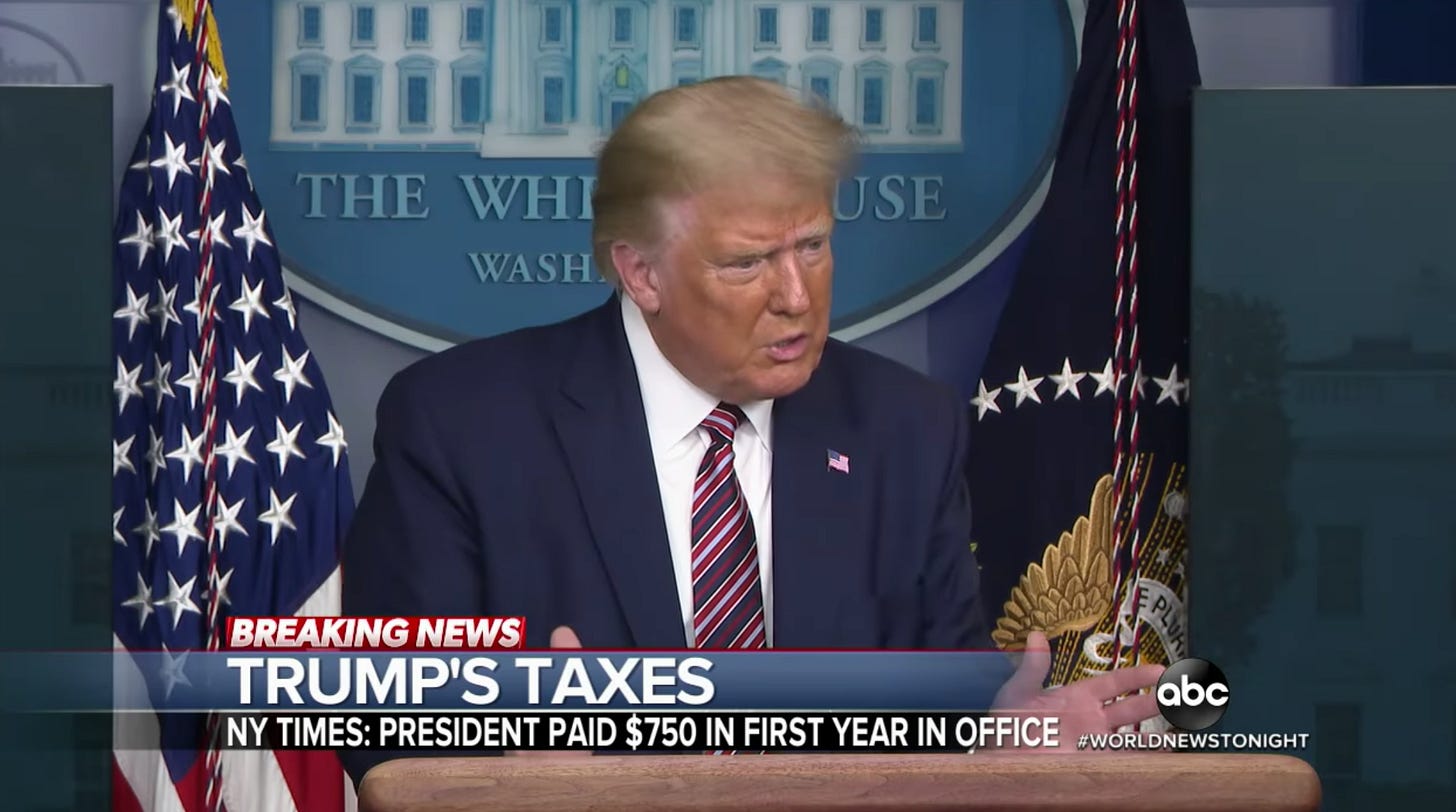

As someone who will be paying off a tax debt plus interest for years because I selfishly prioritized things like “rent” and “food” over “footing the bar tab for a 22-year-old who got a job at HHS because his dad donated $3 million to the RNC,” I’ll just go ahead and admit it: reading the New York Times’ story yesterday about Donald Trump’s taxes—particularly the detail where he reportedly paid $750 in federal income taxes in both 2016 and 2017—was infuriating. Trump got me. Consider this lib triggered. Well done, Mr. President.

It is tempting to see Trump as a uniquely greedy and cheap outlier—and the Times did emphasize that his tax avoidance outstrips that of your average plutocrat. But that is a matter of degrees, not intentions. Trump took advantage of the purposefully hole-ridden system that allows anyone rich enough to hire the right lawyers and accountants not only to bypass one of life’s two certainties (not that one) but maybe make a little extra scratch while doing so. He may have done this to a greater extent than many of his peers, but the central problem is not that Trump is a rat. It’s that our system allows countless rich people to swindle us this way—and gives them the tools to walk away if they get into trouble.

In one particular case, Trump reportedly claimed more than $700 million in years of business losses in 2009, which the Times inferred was likely due to his move that year to walk away from his failing casinos in Atlantic City. From the Times story, emphasis mine:

Business losses can work like a tax-avoidance coupon: A dollar lost on one business reduces a dollar of taxable income from elsewhere. The types and amounts of income that can be used in a given year vary, depending on an owner’s tax status. But some losses can be saved for later use, or even used to request a refund on taxes paid in a prior year.

Until 2009, those coupons could be used to wipe away taxes going back only two years. But that November, the window was more than doubled by a little-noticed provision in a bill Mr. Obama signed as part of the Great Recession recovery effort. Now business owners could request full refunds of taxes paid in the prior four years, and 50 percent of those from the year before that.

Despite not paying any taxes in 2008, the Times reported that Trump used this law, which was sold as assistance for the people hardest hit by the Great Recession, to file for a refund of $70 million—along with nearly $3 million in interest—for business losses dating back to 2005. Thanks Obama and the last unified Democratic government.

It remains to be seen whether or not what Trump did was actually legal. Trump’s tax case is practically old enough to be in middle school at this point and has been reportedly in limbo with the Joint Committee on Taxation for four years and counting, which illustrates an arrangement with the federal government that most of us do not have.

But even before executing the big write-off that landed him the audit, or signing laws that made the tax code even more favorable to the ultra-wealthy, Trump couldn’t believe how much shit the government let him get away with. “When telling me in 2008 that he was cutting employees’ salaries in half, including mine,” Michael Cohen told Congress in February 2019, “[Trump] showed me what he claimed was a $10 million IRS tax refund, and he said that he could not believe how stupid the government was for giving ‘someone like him’ that much money back.” (This likely did not do anything to hinder Trump’s longstanding belief that he had the skillset and intelligence to run the entire federal government.)

The government wasn’t stupid, however, at least not any more than a parent who lets their six-year-old beat them at Connect Four is stupid. And Trump is far from alone. From a 2019 Fortune report (emphasis mine):

Of the Fortune 500 companies that have already filed their 2018 taxes, 60 were profitable and yet avoided all federal income tax, according to an ITEP analysis released on Thursday. The total U.S. income of the 60—which ITEP reports included such names as Amazon, Chevron, General Motors, Delta, Halliburton, and IBM—was more than $79 billion and the effective tax rate was -5%. On the average, they got tax refunds.

Trump was acting just like these corporations do. He was also acting like many, many other rich people, particularly wealthy developers, do—by using all the resources at his disposal, of which there were many, to avoid paying as many tax dollars as he can.

In 2016, New York University professor Aswath Damodaran found that the average effective tax rate across all industries was 11 percent; in real estate development specifically, however, the rate was just 1.1 percent, largely due to the industry’s reliance on depreciation and debt to finance more and more projects.

That this was to be expected, as much as anyone living in most countries in the world expects that elites are committing financial crimes and corruption, makes all of this more depressing. When BuzzFeed News published the FinCEN Files earlier this month, detailing the depths of money laundering and willful ignorance of trillions of dollars of suspicious transactions by some of the world’s leading financial institutions, the response was a collective shrug. More than a few people similarly shrugged when the Times story dropped. We’ve heard this story before, over and over again for years, and nothing—in America, at least—has fundamentally changed.

But despite the fact that we all have corruption fatigue and that most people could have guessed that Trump would be a tax cheat (allegedly), this is a scandal far beyond what Trump was impeached for or Russiagate. The country’s billionaire president effectively put zilch into the public’s coffers for 15 years and had us foot the losses for his business failures. And judging by the astronomical amount he owes in loans coming due in the coming years as well as the spike in revenue in properties like Mar-a-Lago since he became president, he appears to be using the Oval Office as a vehicle to just keep the grift going.

The usefulness of Trump is that this routine tax avoidance scheme has forced the Democrats, who for decades have largely gone along with this program of deregulation and tax cuts and winking as the wealthy hustle the tax code, to acknowledge a problem exists. Richard Neal, the moderate House Ways and Means chairman, said on Sunday night that the Times report “shines a stark light on the vastly different experience people with power and influence have when interacting with the IRS than the average American taxpayer does.”

Does this mean they’ll actually do anything about it? This revelation probably isn’t going to change many votes. And considering the Democratic nominee for president only wants to roll back the corporate tax cuts half of the way and that Neal (who just fought off a primary from the left, aided in no small part by a homophobic smear campaign against his opponent) has been hesitant to commit to even that, it seems unlikely that a unified Democrat government would methodically tackle all of the loopholes that allow people like Trump to rip all of us off like we’re one of his contractors.

But it is further evidence that the ongoing radical upward redistribution of wealth we see everywhere is often enabled by the government, and that the conscious decision to not put an end to it poses yet another existential threat to democracy. It really doesn’t have to be like this; the government can act to heavily tax the rich and powerful and use the money to fund public services and has in the past. And if people want to reduce the power, influence, and mythos surrounding obscenely wealthy people like Donald Trump, there are far worse places they could start than the U.S. tax code.

In case anyone needed a visual representation of how this works: https://twitter.com/nxthompson/status/1310591077003464714?s=20

Excellent article. Speaking of grifting the public for profit, how about that sweet lease he has on public land in West Palm?

https://www.sun-sentinel.com/local/palm-beach/fl-trump-golf-deal-20160617-story.html